epazzar Boyun Sırt Omuz Bel Ayak ve Kol Için Ovmalı Isıtmalı Ayarlanabilir Portatif Masaj Aleti Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

0Pozitif 2021 Model Ovmalı Isıtmalı Masaj Aleti Boyun Sırt Bel Omuz Tüm Vücut Masaj Cihazı Krem Fiyatı, Yorumları - Trendyol

Eragon Kneading Ovmalı Isıtmalı Boyun Bel Sırt Omuz Masaj Yastığı Masaj Aleti Fiyat ve Modelleri | Eragon - Official Online Store

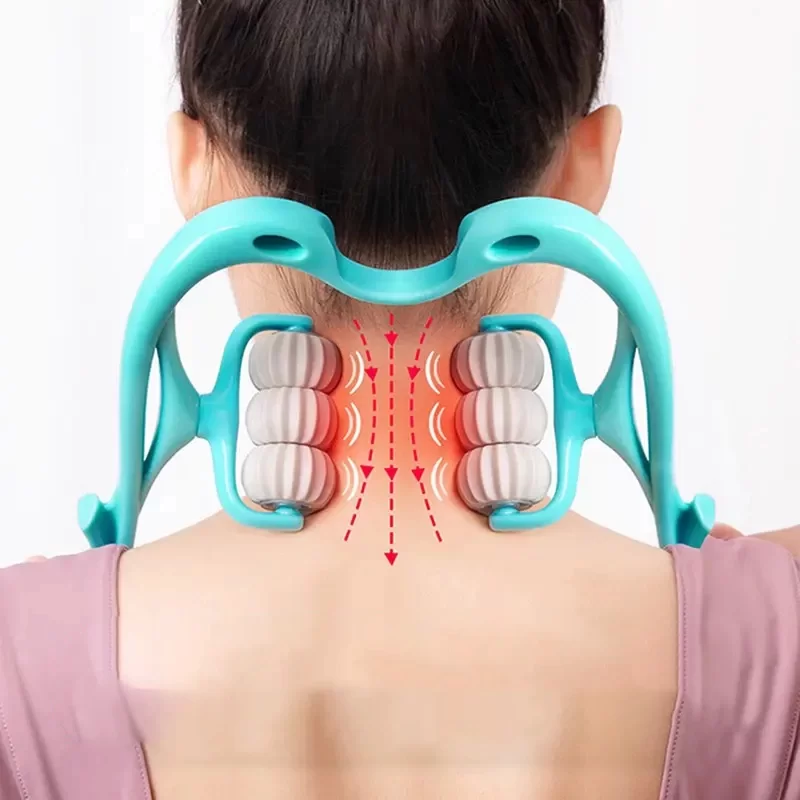

Isıtmalı Boyun Masaj Aleti, Sırt Omuz Boyun Için Elektrikli Masaj Aleti, 2 Güç 6 Başlı Mini Shiatsu Masaj Yastığı, Simülasyon Parmak Masajı, Kas Gevşetme, Yorgunluğu Azaltma : Amazon.com.tr: Sağlık ve Bakım

Boyun Masaj Aleti, Isı Ile Boyun Ve Omuz Için Elektrikli Goletsure Masaj Aletleri, Ağrı Kesici Derin Doku İçin Kadın Erkek Vücut Masaj Aleti, Bacak Bel Masaj Yastığı, Masaj : Amazon.com.tr: Sağlık ve

Küçük Elektrikli Boyun Masajı Servikal Masaj Stimülatörü Artrit Kas Omuz Bacaklar Masaj 6 Modları Tüm Vücut Masaj Aleti Aracı < Güzellik Ve Sağlık > www.schmitz.com.tr

BONJUX Elektrikli Boyun Masaj Aleti Cihazı Omuz Darbe Masajı Servikal Isıtma Tens Yoğurmalı Kas Aleti Fiyatı, Yorumları - Trendyol

Eragon ERG-713 Kneading Şarjlı Ovmalı Isıtmalı Masaj Yastığı Boyun, Omuz, Sırt Masaj Aleti Fiyat ve Modelleri | Eragon - Official Online Store

Elektrikli ısıtma diz masaj aleti sıcak Compress s titreşim omuz masajı bacak dirsek eklem ağrısı giderici fizyoterapi masaj pedi

Kama Shiatsu Isıtmalı Ovmalı Boyun Sırt & Vücut Masaj Aleti Kapıda Ödeme Sipariş Nakit Ödeme Satın Al